- Chase domestic incoming wire fee for free#

- Chase domestic incoming wire fee how to#

- Chase domestic incoming wire fee free#

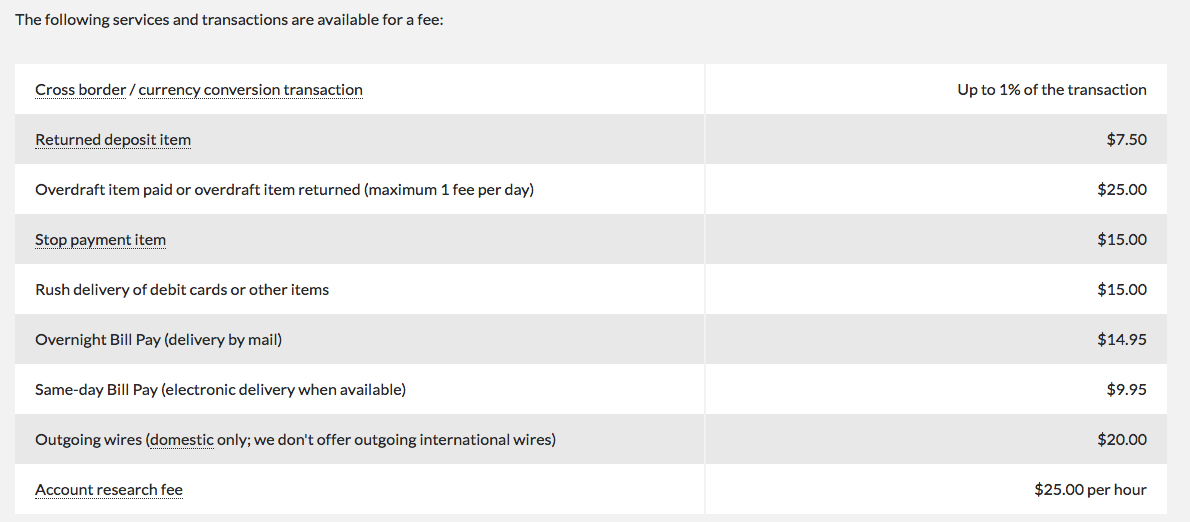

Wire Transfers: What's The Difference?Īnother way to send money is through Automated Clearing House (ACH) transfers, so named because they pass through the automated clearing house, a national electronic network for financial transactions. These rates are not always broadcasted, so it is important to read your account agreement and personal fee schedule to determine if the discount applies to you. There is no guarantee your local bank or credit union offers such a waiver.ĭiscounted Rates for Regular Wire Transfer Senders and/or Recipients: If you regularly send or receive wire transfers, you may qualify for a discounted wire transfer rate. However, many of these institutions only operate in certain regions, limiting their national availability.

Transferring Money to Student Accounts: When sending money to a student, many smaller banks and credit unions will actually waive or reduce any incoming wire transfer fees to student accounts, so that a parent or guardian isn't charged twice.

Chase domestic incoming wire fee free#

Wells Fargo: Members with the PMA package checking account and qualifying balances of at least $250,000 receive free incoming wire transfers. TD: TD Relationship Checking and TD Premier Checking account holders get free incoming domestic and international wire transfers. PNC: PNC Performance Select Checking account holders pay no fees on incoming or outgoing domestic wire transfers. Advance Savings and Checkings members pay the decreased $12 incoming domestic and international wire transfer fee. HSBC: HSBC Premier Checking and Savings account holders can receive free incoming domestic and international wire transfers. Like Chase, Citi offers a $10 discount on online-initiated wire transactions: outgoing online domestic wires are $25 and outgoing online international wires are $35. Chase offers $10 discounts on outgoing wires initiated online, making outgoing online domestic wires $25 (originally $35) and outgoing online international wires $40 (originally $50).Ĭiti: Individuals with Citigold Accounts also receive free incoming domestic and international wire transfers. Incoming domestic and international wires. Here are some examples that we found for America's biggest banks:īank of America: Rewards Money Market Savings account and Interest Checking Account holders can receive free incoming domestic wire transfers other wire fees apply.Ĭhase: Chase Premier Platinum Checking account holders receive free

Furthermore, some institutions offer discounts for wire transfers that are initiated online.

Chase domestic incoming wire fee for free#

Having a certain savings or checking account with a bank may sometimes qualify an individual for free or discounted wire transfer services.

Chase domestic incoming wire fee how to#

How to Waive or Reduce Wire Transfer Fees However, a representative stated that the fees would most likely be in a range from $20-$35. HSBC does not list rates for outgoing domestic and foreign wire transfers until the time of transaction. The existence of a fiduciary duty does not prevent the rise of potential conflicts of interest.-Capital One 360 does not currently offer international wire transfer services There are no guarantees that working with an adviser will yield positive returns. Working with an adviser may come with potential downsides such as payment of fees (which will reduce returns). All investing involves risk, including loss of principal. This is not an offer to buy or sell any security or interest. We do not manage client funds or hold custody of assets, we help users connect with relevant financial advisors.

SmartAsset does not review the ongoing performance of any RIA/IAR, participate in the management of any user’s account by an RIA/IAR or provide advice regarding specific investments. SmartAsset’s services are limited to referring users to third party registered investment advisers and/or investment adviser representatives (“RIA/IARs”) that have elected to participate in our matching platform based on information gathered from users through our online questionnaire. Securities and Exchange Commission as an investment adviser. SmartAsset Advisors, LLC ("SmartAsset"), a wholly owned subsidiary of Financial Insight Technology, is registered with the U.S. Diamond members get three free wires/month Free for Citi Private Bank, Citigold® Private Client and Citi Global Executive Preferred accounts Free if processed online and in foreign currency worth at least $5,000 USD Three free transfers per quarter for customers with $100,000 or more in household balances. Free for Platinum and Platinum Honors Preferred Rewards customers. Free for Interest Checking/Advantage accounts and Preferred Rewards customers.

0 kommentar(er)

0 kommentar(er)